e-Way bill requirement

E-Way bills are digitally generated documents mandated by the Indian government for the transportation of goods under certain conditions. This document helps the government prevent tax evasion and ensure transparency in the movement of goods within India.

This document is solely mandatory under these conditions:

- If the goods carried exceed a particular value (this value starts at 50,000 INR and varies by state), it is recommended that you check state regulations, especially for interstate transfers, regardless of mode of transportation.

- If the items are transported interstate for job work, regardless of their value.

- If the goods are handcrafted products, regardless of their value.

This document is not mandatory under these conditions.

- If the transported goods are valued less than 50,000 INR, regardless of their destination.

- If the goods are transported using a non-motorized vehicle, regardless of their worth.

- f the departure place is a port, airport, air cargo station, or any other station where the Customs Department has issued clearance.

- If transported goods are tax exempt, regardless of their total value.

e-Way bill format

An e-Way bill has two parts, Part A and Part B.

- Part A contains the details of a consignor, consignee, type of supply, item details, and mode of transportation.

- Regular: This is a normal transaction type where the order is both billed and dispatched or shipped from the same state.

- Bill to - Ship to: Imagine you own a wholesale furniture store. A retail store orders furniture worth 1,000,000 INR and wants it be delivered straight to the consumer rather than to them. So, in this case, the transaction should be billed to the retailer and shipped to the consumer's address.

- Bill from - Dispatch from: Imagine you manage a retail hardware store where you don't have physical stock and rely solely on the manufacturer for delivery, who is in a different state. A customer places an order of 55,000 INR to you. So, in this case, since you will be raising the invoice for your customer, the order will be billed from your address and dispatched from the manufacturer's address.

- Combination of A and B: Imagine a scenario where you manage a wholesale hardware store in Tamil Nadu and rely on a manufacturer in Karnataka for supplies. You receive an order from a shop in Goa, who requests you transport it to their Andhra Pradesh location. In this case, the transaction must be billed from you since you will be raising the invoice with the shop. However, the goods will be dispatched from the manufacturer. Simultaneously, as the order was placed by the retailer, the transaction needs to be billed to their address in Goa, but since the goods will be transported to another store in Andhra Pradesh, the transaction needs to be shipped to that address.

- Part B contains details of the transporter (details of the firm that transports the goods).

Transaction type

In Part A, there are four different transaction types that you can choose based on your business condition.

You can furnish both Part A and Part B details if you are transporting the goods on your own by registering yourself as a transporter. If you are outsourcing the transportation, then Part B details should be filled out by the transporter's firm. You can also authorize a consignee, such as the buyer, transporter, courier agency, or ecommerce operator, to fill out Part A of the e-Way bill on your behalf.

Note

- To register as a transporter, you need to enter the GSTIN number in the transporter's ID space.

- If the transporter or the vehicle changes during transportation, then the Part B details should be updated accordingly.

e-Way bill validity

The validity of the e-Way bill is entirely dependent on the distance traveled by the transporter.

A regular vehicle has one day of validity for every 100 kilometers or part of its movement. Over-dimensional cargo trucks are granted one day of validity for every 20 kilometers or part of their trip.

For example, if you create an e-Way bill between 00:01 hrs. and 23:59 hrs. on June 10, its one-day validity ends at 00:00 hrs. on June 12, day two validity would end at 00:00 hrs. on June 13, and so on.

Note

- Over-dimensional cargo refers to any consignment that exceeds the standard size and weight limitations set for vehicles on public roads. These limitations can vary depending on the location, but generally include restrictions on height, width, and length.

Generate e-Way bills

e-Way bills can be generated in two ways:

- It can be generated in Zakya itself.

- It can be generated from the EWB (e-Way Bill Portal).

Generate e-Way bills in Zakya

To generate e-Way bills in Zakya, you must first register Zoho Corporation as your GSP (GST Suvidha Provider) in the e-Way billing system. A GSP operates as a bridge between your business and the e-Way bill site, allowing you to generate e-Way bills quickly and easily. Since generating an e-Way bill directly from the EWB (e-Way Bill) portal requires you to enter every detail manually, if you have to generate several e-Way bills for your day-to-day transactions, it will become a tedious process. With Zoho as your GSP, our platform can help you create e-Way bills directly from your invoice, credit note, or delivery challan; you are only required to enter your transporter’s details, while Zakya auto-populates the rest.

Register Zoho as GSP

Note

- This is a one-time registration. Once registered, you can generate e-Way bills.

- Log into the EWB portal (https://ewaybill.nic.in/).

- Scroll down in the left navigation panel and click the Registration dropdown.

- Select For GSP from the menu. Your GST registered email ID and phone number are auto-populated.

- Click Send OTP and you will receive a one-time password to you registered mobile number.

- Enter the six-digit OTP and click Verify OTP.

- Click the Add/New button on the following screen.

- Select Zoho Corporation in the GSP Name dropdown.

- Enter the Suffix ID and a password

- Re-enter the user name and password.

- Click Add.

After successful registration, Zoho Corporation will be listed under the View tab, and you will be able to generate e-Way bills through Zakya.

Connect Zakya with the e-Way Bill Portal

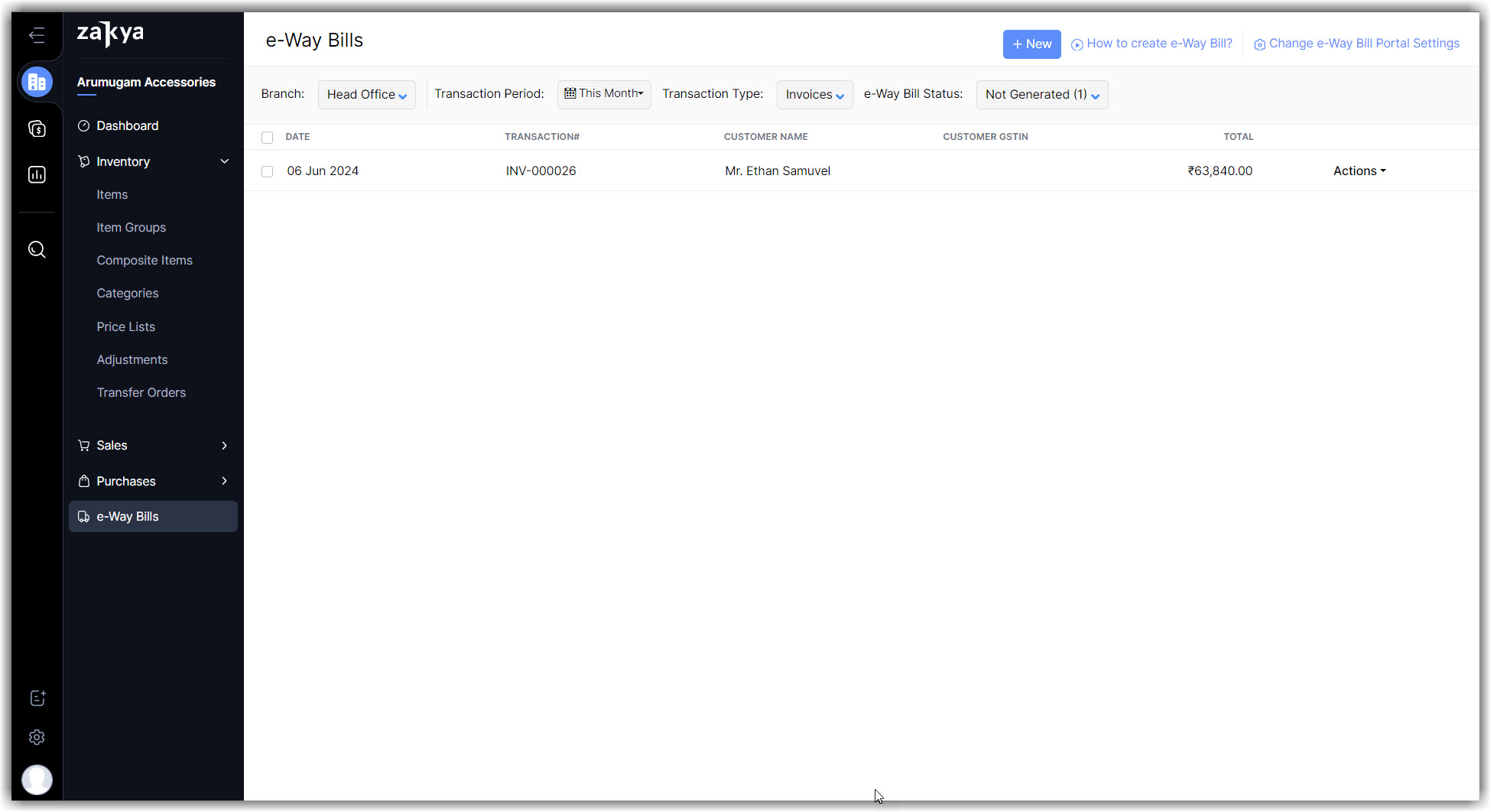

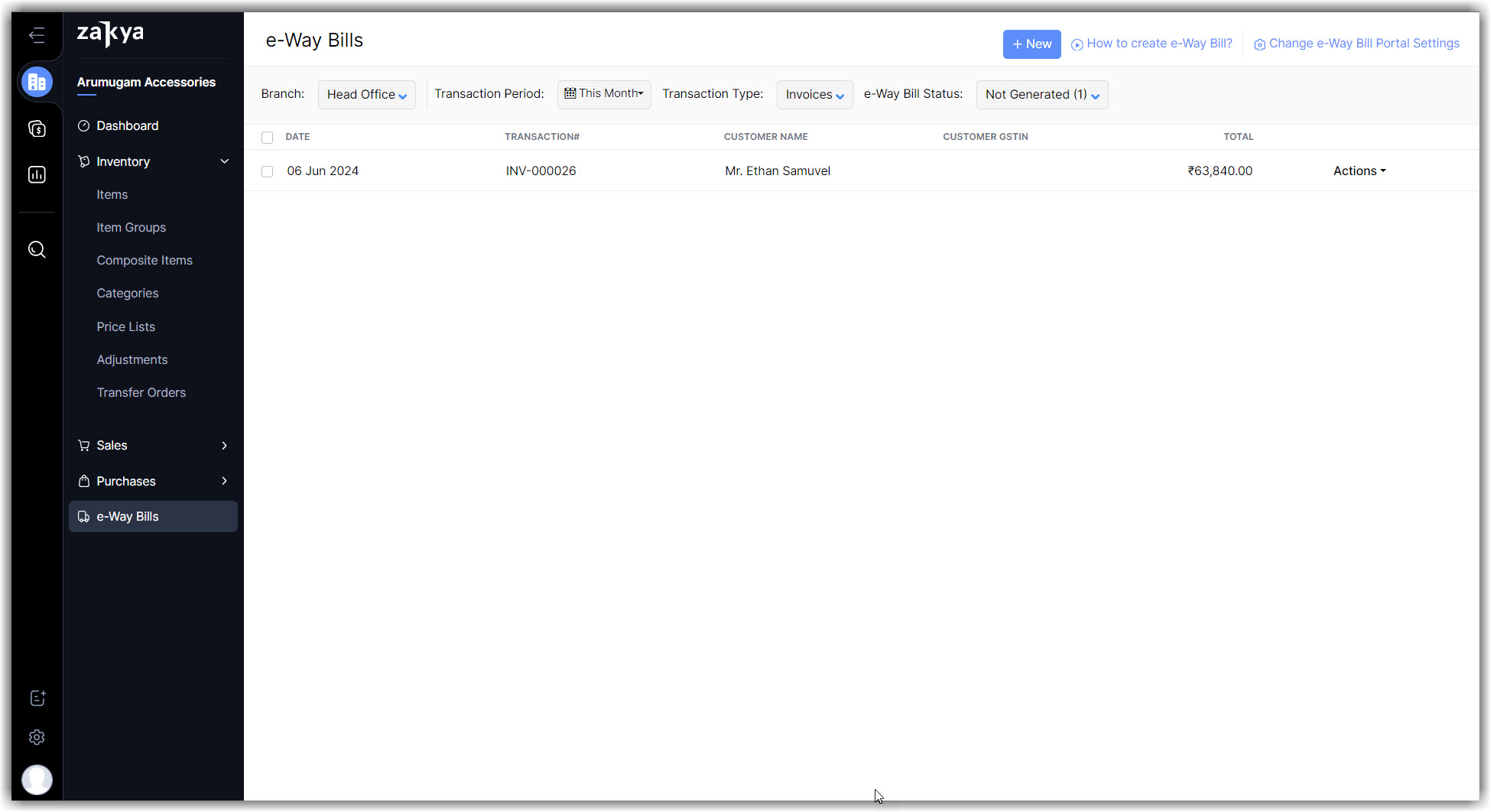

- Navigate to the e-Way bills module in the Business module.

- Click Change e-Way Bill Portal Settings in the top right corner of the page.

- Click the Connect Now button under Actions.

- Enter the Username and Password that you used while registering Zoho Corporation as your GST Suvidha Provider(GSP) in the e-Way Bill Portal and click Save & Validate.

Generate e-Way bill

After connecting Zakya with the e-Way Bill Portal, e-Way bills can be generated either from the e-Way bill module or directly from the transaction.

a) From the e-Way bill module

- Navigate to the e-Way bills module in the Business section.

- Select the Transaction Period, Transaction Type, and keep the e-Way bill status as Not Generated.

- Click the transaction for which an e-Way bill has to be generated.

- Enter the details in the required fields.

- You can either click Save to convert the transaction into an e-Way bill in Zakya or click Save and Generate to convert the transaction and generate the e-Way bill in the e-Way Bill Portal.

b) From transactions

You can also generate e-Way bills directly from the transactions. Let's create an e-Way bill for an invoice.

- Navigate to Sales > Invoices.

- Click the transaction for which the e-Way bill has to be generated.

- Click Add e-Way Bill Details.

- Choose Create New e-Way Bill in the Add e-Way Bill Details pop-up window.

- Enter the details in the required fields and click Save or Save and Generate to create an e-Way bill.

Similar steps can be followed to generate e-Way bills from other transactions like credit notes and delivery challans.

Note

- As per government norms, in the case of a sales return, e-Way bills that are created for a credit note are saved with the document type Delivery Challan in Zakya.

Generate e-Way bills from EWB (e-Way Bill) portal

If you want to generate e-Way bills from the EWB portal, you can simply follow this three step process:

Step 1: Export your invoices or credit notes as a JSON or Excel

Before bulk exporting your transactions, it is advised to open them and check whether all the mandatory fields like Customer Shipping PIN Code, Place of Supply, Distance, and other fields are filled.

- Navigate to the e-Way bills module in the Business section.

- Select the transaction by clicking the checkbox near it and click Export as JSON.

Step 2: Upload the JSON file to the EWB portal

- Log into the EWB portal (https://ewaybill.nic.in/)

- Navigate to the e-Way Bill section in the side bar of the homepage.

- Select Generate Bulk from the dropdown.

- Click Browse and select the JSON file from your system.

- Click Upload to load the JSON into the EWB portal.

Step 3: Associate the e-Way bill with the transaction

As per the GST regulation, it is mandatory to display the e-Way bill number on invoices, credit notes, and delivery challans. Hence, if you have generated the e-Way bills in the EWB portal, you need to update the e-Way bill number in Zakya.

- Navigate to Sales > Invoice.

- Click on the respective transaction to view its details.

- If your transaction value is more than 50,000 INR, click Add e-Way Bill Details in the invoice details page. (or)

If the invoice value is less than 50,000 INR, then click on the epsilon icon and select Add e-Way Bill Details.

- Choose Associate e-Way Bill Number in the pop-up.

- Enter the e-Way bill number in the pop-up box and make sure there is no space between the numbers and click Save.

Sync and update e-Way bills

To ensure all your business transactions are up to date after associating the e-Way bill with transactions in Zakya, you have to sync your e-Way bill module with the e-Way bill and fetch the validity details and any updates made to the e-Way bill in the portal.

- Navigate to the e-Way bills module in the Business section.

- Select the e-Way bill status as Generated.

- Click the Actions dropdown and choose the Fetch from Portal option to update your e-way bill details in your business.

To learn more, read this FAQ section on e-Way bills.